TransUnion CIBIL Limited is India’s first Credit Information Company, also commonly referred to as a Credit Bureau. CIBIL and other Credit Information Companies like Equifax and Experian collect and maintain records of individuals’ and non-individuals’ (commercial entities) payments pertaining to loans and credit cards. These records are submitted to them by banks and other lenders on a monthly basis; using this information a Credit Information Report (CIR) and Credit Score is developed by the Credit Information Companies, enabling lenders to evaluate and approve loan applications. A Credit Bureau is licensed by the RBI and governed by the Credit Information Companies (Regulation) Act of 2005. A Credit Score or the CIBIL Score is a three-digit numeric summary of your credit history. The score is derived using the credit history found in the CIR. A CIR is an individual’s credit payment history across loan types and credit institutions over a period of time. A CIR does not contain details of your savings, investments or fixed deposits.

TransUnion CIBIL Limited is India’s first Credit Information Company, also commonly referred to as a Credit Bureau. CIBIL and other Credit Information Companies like Equifax and Experian collect and maintain records of individuals’ and non-individuals’ (commercial entities) payments pertaining to loans and credit cards. These records are submitted to them by banks and other lenders on a monthly basis; using this information a Credit Information Report (CIR) and Credit Score is developed by the Credit Information Companies, enabling lenders to evaluate and approve loan applications. A Credit Bureau is licensed by the RBI and governed by the Credit Information Companies (Regulation) Act of 2005. A Credit Score or the CIBIL Score is a three-digit numeric summary of your credit history. The score is derived using the credit history found in the CIR. A CIR is an individual’s credit payment history across loan types and credit institutions over a period of time. A CIR does not contain details of your savings, investments or fixed deposits.

PS: We are neither a Credit Rating Agency nor we have any association with any Credit Rating Agency like CIBIL, Experian, Equifax or CRIF High Mark - which are the only Credit Rating Agencies in India. This is Just for Educational Purposes.

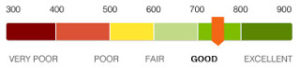

The Credit Scores developed by the Credit Information Companies like CIBIL, Equifax and Experian play a critical role in the loan application process. After an applicant submits the loan application form to the lender, the lending institution first checks the credit score and credit report of the applicant. If the credit score is low, the lender may not even consider the application further and reject it at the first point. If the credit score is high, the lender will look into the application and consider other details to determine if the applicant is creditworthy or not. The credit score works as a first impression for the lender, the higher the score, the better are your chances of the loan being reviewed and approved. The decision to lend is solely dependent on the lender and CIBIL or other Credit Rating Agencies do not in any manner decide if the loan/credit card should be sanctioned or not.

The Credit Scores developed by the Credit Information Companies like CIBIL, Equifax and Experian play a critical role in the loan application process. After an applicant submits the loan application form to the lender, the lending institution first checks the credit score and credit report of the applicant. If the credit score is low, the lender may not even consider the application further and reject it at the first point. If the credit score is high, the lender will look into the application and consider other details to determine if the applicant is creditworthy or not. The credit score works as a first impression for the lender, the higher the score, the better are your chances of the loan being reviewed and approved. The decision to lend is solely dependent on the lender and CIBIL or other Credit Rating Agencies do not in any manner decide if the loan/credit card should be sanctioned or not.

PS: We are neither a Credit Rating Agency nor we have any association with any Credit Rating Agency like CIBIL, Experian, Equifax or CRIF High Mark - which are the only Credit Rating Agencies in India. This is Just for Educational Purposes.

Banks and Financial institutions ask for a guarantor for certain loans as a means of security for the loans sanctioned by them. A guarantor of any form of loan is equally responsible for ensuring the repayment of the loan. As per Law, the liability of the Guarantor is co-extensive with that of Principal Borrower. Hence, the guarantor provides a guarantee to the lender that he will honor the obligation in case the principal applicant is unable to do so. Any default on the payment of the loan by the principal will also affect your Credit Score of Guarantor as well.

While every Credit Bureau or Credit Information Company applies their own developed computerized algorithm, which is highly complicated and does not involve any manual intervention, for calculating the Individual’s Credit Score but the underlying principles remain the same as these principles revolve around the repayment behavior of the Individual. However, CIBIL Score is calculated considering only your “Accounts” and “Enquiry” sections in your CIBIL Report.

While every Credit Bureau or Credit Information Company applies their own developed computerized algorithm, which is highly complicated and does not involve any manual intervention, for calculating the Individual’s Credit Score but the underlying principles remain the same as these principles revolve around the repayment behavior of the Individual. However, CIBIL Score is calculated considering only your “Accounts” and “Enquiry” sections in your CIBIL Report.

PS: We are neither a Credit Rating Agency nor we have any association with any Credit Rating Agency like CIBIL, Experian, Equifax or CRIF High Mark - which are the only Credit Rating Agencies in India. This is Just for Educational Purposes.

Credit Rating Agencies and Lending Bankers and Financial Institutions are doing blunders and injustice to honest Loan Payers when they find that their CIBIL, Experian, Equifax or CRIF High Mark Credit Report brands them as a defaulter. There is no Law in India to protect the interest of the consumers to sue the Credit Bureaus or Credit Institutions for wrong Reporting. However, a recent Landmark Judgement has been passed by the Consumer Form Mohali.

Credit Rating Agencies and Lending Bankers and Financial Institutions are doing blunders and injustice to honest Loan Payers when they find that their CIBIL, Experian, Equifax or CRIF High Mark Credit Report brands them as a defaulter. There is no Law in India to protect the interest of the consumers to sue the Credit Bureaus or Credit Institutions for wrong Reporting. However, a recent Landmark Judgement has been passed by the Consumer Form Mohali.

PS: We are neither a Credit Rating Agency nor we have any association with any Credit Rating Agency like CIBIL, Experian, Equifax or CRIF High Mark - which are the only Credit Rating Agencies in India. This is Just for Educational Purposes.

The answers is a big "No" as under the Indian Contract Act the minors are incompetent to enter into any contract and as such, no Bank or Financial Institution grants Loans to Minors. Credit Bureaus do not provide any Credit Report to the minors but the minors on attaining majority can fetch their Credit Report immediately on the next day on which they complete 18 years of age to become Major. But such report will obviously be a "No Hit" report with Credit Score as -1 (Minus 1). Loan and Credit Report Consultants are of the view that every individual after crossing the age of 18 must keep vigilance on the movement of their CIBIL Credit Scores at regular intervals. Read More here. CIBIL Consultants have devised their SILVER ANNUAL PACKAGE to keep a check on their Credit Report on 1st of every month

PS: We are neither a Credit Rating Agency nor we have any association with any Credit Rating Agency like CIBIL, Experian, Equifax or CRIF High Mark - which are the only Credit Rating Agencies in India. This is Just for Educational Purposes.

Whereas CIBIL Score is allocated to the Individuals, the CIBIL Rank is given to Firms, Companies, Trusts, Societies and Businesses having outstanding loans of Rs.10 Lacs to Rs.10 Crores. While Individual CIBIL Reports and CIBIL Scores can be generated online, for getting the Commercial Credit Report or CCR for any Business, the owner of the Business has to apply manually and the CCR is provided by the CIBIL authorities within 30-35 days of the submission of physical documents along with the prescribed fees. Read More Here.

PS: We are neither a Credit Rating Agency nor we have any association with any Credit Rating Agency like CIBIL, Experian, Equifax or CRIF High Mark - which are the only Credit Rating Agencies in India. This is Just for Educational Purposes.

Generally, the Public asks me that they want to completely wash out and clear their previous bad Credit History from their Credit History. How is it possible? Credit History is also the replica of your Good or bad Financial Karmas and it is something similar to “Theory of Karma in Hinduism” which works on the principle of “As You Sow, So Shall You Reap”. The Good Karmas get converted into virtuous deeds and Bad Karmas become sinful deeds. While you enjoy the fruits of Good Karma, you are also to pay for your bad karmas. It is not possible that that Bad Karmas can be written off against Good Karmas. Similarly, it is not possible to completely wash out the Bad Credit History from the Credit Reports.

Generally, the Public asks me that they want to completely wash out and clear their previous bad Credit History from their Credit History. How is it possible? Credit History is also the replica of your Good or bad Financial Karmas and it is something similar to “Theory of Karma in Hinduism” which works on the principle of “As You Sow, So Shall You Reap”. The Good Karmas get converted into virtuous deeds and Bad Karmas become sinful deeds. While you enjoy the fruits of Good Karma, you are also to pay for your bad karmas. It is not possible that that Bad Karmas can be written off against Good Karmas. Similarly, it is not possible to completely wash out the Bad Credit History from the Credit Reports.

PS: We are neither a Credit Rating Agency nor we have any association with any Credit Rating Agency like CIBIL, Experian, Equifax or CRIF High Mark - which are the only Credit Rating Agencies in India. This is Just for Educational Purposes.

Inquiries mean how many times have you applied for a loan or card..? Each time you are applying for new credit, the lender will have to make an inquiry with the Credit Bureau to determine your creditworthiness. The inquiry may or may not have an effect on your Credit Score. It depends on whether the enquiry is a Soft Enquiry or a Hard Enquiry.

Inquiries mean how many times have you applied for a loan or card..? Each time you are applying for new credit, the lender will have to make an inquiry with the Credit Bureau to determine your creditworthiness. The inquiry may or may not have an effect on your Credit Score. It depends on whether the enquiry is a Soft Enquiry or a Hard Enquiry.

NOTE: All the enquiries which are made on your Credit Report remain there forever. However, you need not to panic, as most financial institutions only consider the Enquiries made only during the last two years. Just try to keep your Credit Scores high before you apply for Loans or Credit Cards so that the Hard Enquiries result into Sanction of Loans and/or Credit Cards as Rejections coupled with Hard Enquiries can lower your Credit Scores. It is always better to take help from a Trusted and Leading Professional Credit Consulting Company like Credit Report Consultants.

PS: We are neither a Credit Rating Agency nor we have any association with any Credit Rating Agency like CIBIL, Experian, Equifax or CRIF High Mark - which are the only Credit Rating Agencies in India. This is Just for Educational Purposes.

Soft Enquiry: When you obtain your Credit Report from any of the Credit Rating Agency like CIBIL, Experian, Equifax, and CRIF High Mark yourself with the assistance of Professional Consultants like Credit Report Consultants to monitor your own Credit Scores, or to check for discrepancies, then it is viewed as a Soft Enquiry. The same goes for when your lender or bank does a Periodic Review of their existing accounts. Banks in India, being ignorant about the Concepts do not bother to click the appropriate options while reviewing the Credit Reports of their existing customers and thus harm the interests of their own customers. However, in case the Banks do their part of the job properly then in both the cases your Credit Score is not impacted. Plus, you can make as many soft inquiries as you want without worrying about your Scores.

Soft Enquiry: When you obtain your Credit Report from any of the Credit Rating Agency like CIBIL, Experian, Equifax, and CRIF High Mark yourself with the assistance of Professional Consultants like Credit Report Consultants to monitor your own Credit Scores, or to check for discrepancies, then it is viewed as a Soft Enquiry. The same goes for when your lender or bank does a Periodic Review of their existing accounts. Banks in India, being ignorant about the Concepts do not bother to click the appropriate options while reviewing the Credit Reports of their existing customers and thus harm the interests of their own customers. However, in case the Banks do their part of the job properly then in both the cases your Credit Score is not impacted. Plus, you can make as many soft inquiries as you want without worrying about your Scores.

Hard Enquiry: When you apply for a loan or a credit card, then the lending Banker invariably performs a Credit Check. They contact the Credit Bureau and seek your credit report for evaluation. This kind of inquiry is viewed as a Hard Enquiry, and it bears significance, as it impacts your Credit Scores. In fact, the amount of damage that your score takes is directly proportional to the total number of inquiries made in a short period of time. If you want to make a good impression on your future lender then you would not want to look at multiple hard inquiries on your report. It is prudent on the part of the individual to make Soft Enquiries first and apply for the Loan or Credit Cards only if their Credit Score is good enough to get the Credit Sanctions as in the case of rejection of loan, the Hard Enquiries by the Bank to whom you apply for loan or credit card - can adversely impact your Credit Scores.

PS: We are neither a Credit Rating Agency nor we have any association with any Credit Rating Agency like CIBIL, Experian, Equifax or CRIF High Mark - which are the only Credit Rating Agencies in India. This is Just for Educational Purposes.

NOTE: All the inquiries which are made on your Credit Report remain there forever. However, you need not to panic, as most financial institutions only consider the Enquiries made only during the last two years. Just try to keep your CIBIL Scores high before you apply for Loans or Credit Cards so that the Hard Enquiries result into Sanction of Loans and/or Credit Cards as Rejections coupled with Hard Enquiries can lower your CIBIL Credit Scores. It is always better to take help from a Trusted and Leading Professional Credit Consulting Company like CIBIL Consultants.

CMR Rank is given to companies, firms, trusts, and corporate bodies with a current credit exposure of up to Rs. 50 crores. Non-availability of CMR Rank is not a negative thing. You can evaluate your company’s credit performance based on your Company Credit Report (CCR).

CMR Rank is given to companies, firms, trusts, and corporate bodies with a current credit exposure of up to Rs. 50 crores. Non-availability of CMR Rank is not a negative thing. You can evaluate your company’s credit performance based on your Company Credit Report (CCR).

More “FAQs” to come Depending on the Visitor’s Feedback. Visit this Page after a fortnight to know the answers to your burning questions about Credit Scores and Credit Reports. Every FAQ will be dealt with in very simple, easy-to-understand language.

IMPORTANT NOTICE: We have no association with any Credit Rating Agency like CIBIL, Experian, Equifax, or CRIF High Mark – which are the only Credit Rating Agencies in India.